DUSHANBE (Reuters) – Tajikistan’s central bank cut its refinancing rate on Monday from 9.0 to 8.0%, its third reduction in less than four months, after inflation eased last year.

- Sources: International Monetary Fund. 2011. World Economic Outlook database. September; Tajikistan State Statistics Agency (http://www.stat.tj – accessed 15 March 2012); ADB estimates.

The central bank last cut the key rate on Feb. 27, to 9.0% from 9.8%. It had cut the rate from 10.0% on Dec. 20.

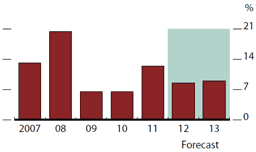

Asian Development Bank (ADB) forecasts the inflation to stay around 8.5-9.0% in the next 2 years in Tajikistan, as upward pressures on non-food prices from higher imports and other factors offset the impact of moderating food prices. The Russian Federation is considering exempting from export duties only a fraction of oil products exported to Tajikistan, so inflation pressures from high fuel prices will persist in 2012. Additional pressure is likely to come if the government proceeds with plans to raise electricity tariffs.

Despite persisting inflation, monetary policy may need to reflect more of a balance between supporting economic recovery and ensuring price stability, given the expected slowdown in growth and the limited volume of loanable funds for the economy. Slowing inflation has already led the central bank to reduce the refinancing rate from 9.8% in December 2011 to 9.0% in February 2012, and it may follow with further steps to more expansionary monetary policy. Weak external performance is expected to put further downward pressure on the national currency.