Thursday 17 September 2020

OPEC+ May Hold Extraordinary October Meeting

Keywords: COVID-19, OPEC, Saudi Arabia

MOSCOW, LONDON, DUBAI (Reuters) — OPEC+ could hold an extraordinary meeting in October if oil markets weaken further, Saudi Energy Minister Prince Abdulaziz bin Salman said on Thursday, according to an OPEC+ source.

Prince Abdulaziz was speaking at a closed-door meeting of OPEC and its allies, led by Russia, which pressed for better compliance with oil output cuts against the backdrop of falling crude prices as uncertainty reigns over the global economic outlook.

“Full compliance is not an act of charity. It is an integral part of our collective effort to maximize the interest and gains of every individual member of this group”, Prince Abdulaziz said as he opened a key OPEC+ panel, known as the joint ministerial monitoring committee (JMMC), sitting beside the UAE Energy Minister Suhail bin Mohammed al-Mazroui. The ministerial panel said it was concerned about the rise in the cumulative overproduction, which has reached 2.38 million bpd from May until August, according to the report.

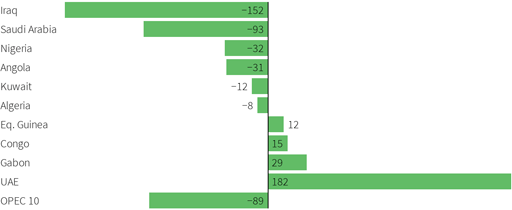

- OPEC deiviation from production cuts in August 2020

- In ’000 barrels/day.

Source; Internal OPEC+ document

(Click to enlarge)

OPEC+ warned that rising COVID-19 cases in some countries could curb energy demand despite initial indications of a decline in oil stocks, according to a draft press release and internal document seen by Reuters on Thursday.

Oil prices rose about 2% on Thursday, turning positive as OPEC+ said the producer group would crack down on countries that failed to comply with output cuts. The panel of major producers, including Saudi Arabia and Russia, did not recommend any changes to their current output reduction target of 7.7 mln barrels per day (bpd), or around 8% of global demand, according to a draft press release and an internal report.

The panel pressed laggards such as Iraq, Nigeria and the United Arab Emirates to cut more barrels to compensate for overproduction in May-July, while extending the compensation period from September to the end of December, according to three OPEC+ sources.

“They were coming down hard on the UAE”, said Phil Flynn, senior analyst at Price Futures Group in New York. The expectation that output could fall as the UAE and others trim production bolstered prices, he said.