LONDON (Reuters) — Oil prices rose on Monday, reversing an earlier fall to multi-year lows as hopes of a deeper cut in output by OPEC and stimulus from central banks countered worries about damage to demand from the coronavirus outbreak.

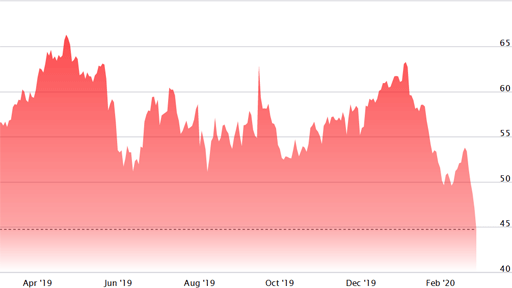

Brent crude was at $50.40 a barrel, up ¢73 by 11:46 GMT, having earlier hit its lowest since July 2017 at $48.40. WTI crude hit a 14-month low of $43.32 but was last trading at $45.29, up ¢53.

- WTI Crude Oil – 1 Year

- Oil prices are down more than 20% since the start of the year despite OPEC+ curbing oil output by 1.7 mln bpd under a deal that runs to the end of March.

(Source: Nasdaq)

Data released over the weekend by China, the world’s top energy consumer, dragged on oil prices earlier in the session. Factory activity in the country shrank at the fastest pace ever in February, underscoring the colossal damage from the cornoavirus outbreak on its economy..

Meanwhile, several key members of the OPEC are considering an additional production cut in the second quarter with fears the virus outbreak will erode oil demand. The previous proposal was for an additional output cut of 600,000 bpd. Russian Energy Minister Alexander Novak said on Monday that Moscow is evaluating the smaller oil production cut proposal made by OPEC+, adding it had not received a proposal for deeper cuts.

Today gain was the first for both Brent & WTI benchmarks after six sessions of losses triggered by coronavirus worries.