LONDON, NEW YORK (Reuters, Nasdaq) — Oil prices held near two-month highs on Friday, set for a third consecutive week of gains on expectations of an extension to OPEC+ production cuts, though concern over U.S.-China trade talks continue to hang over the market.

Brent crude futures LCOc1 dropped ¢17 to $63.80 a barrel by 1219 GMT and West Texas Intermediate (WTI) crude futures CLc1 fell ¢31 to $58.27.

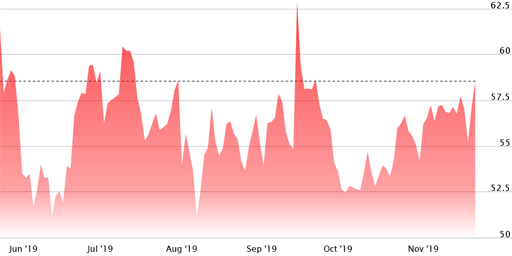

- Crude Oil (CL:NMX)

- November 21, 2019:

Last $58.26; 52 Week High $66.3; 52 Week Low $42.53

(Source: Nasdaq)

Prices touched their highest since late September on Thursday after Reuters reported that the Organization of the Petroleum Exporting Countries (OPEC) and Russia are likely to extend existing production cuts by another three months to mid-2020 when they meet over December 5-6. The group will also emphasize the need for stricter deal compliance from the likes of Iraq and Nigeria.

“A disciplined approach from Iraq and Nigeria should shave off another 300-400,000 barrels per day (bpd) from the group’s production level leading to a balanced market in the first half of 2020 and to a possible supply deficit in the second half”, said oil brokerage PVM.

The current agreement is for a production cut of 1.2 mln bpd until the end of March.

Uncertainty over whether the United States and China will be able to reach a partial trade deal that would lift some pressure on the global economy kept a lid on prices.