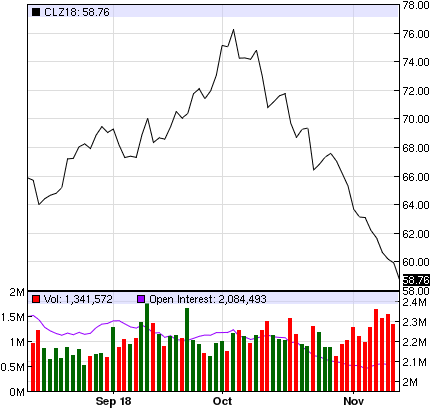

NEW-YORK (NASDAQ) — On the NYMEX, the barrel of WTI crude oil (December contract) still stumbles by 2.2% to $58.6 today, while the barrel of Brent loses 2% to $68.7. Oil prices had unsuccessfully attempted a technical rebound yesterday, after a drop of about 20% in crude oil prices since the beginning of October (with increases in offers from the USA, Saudi Arabia or Russia).

- WTI (NYMEX) Price

- End of day Commodity Futures Price Quotes for Crude Oil WTI (NYMEX)

(Source: NASDAQ)

“Hopefully, Saudi Arabia and OPEC will not be cutting oil production. Oil prices should be much lower based on supply!”, Donald Trump said last night on Twitter.

Saudi Arabia, a major oil exporter and OPEC leader, has announced a scheduled reduction in its oil production for December. The Saudi Minister of Energy Khaled al-Faleh announced that he plans to reduce his oil supply to world markets by 500,000 barrels/day in December. Iraq and Kuwait — also members of OPEC — as well as other exporters, may also consider reducing their offers next year.

Following the Joint Ministerial Monitoring Committee (JMMC) OPEC/non-OPEC meeting in Abu Dhabi, Saudi Arabia also explained that the analyses showed the need for a production reduction of 1 million barrels/day. Russia, on the other hand, asked OPEC and its partners to react in moderation. The Russian authorities thus warn against hasty decisions.